If you have filed a personal injury claim after an accident, there will come a time when the insurance company will begin negotiations for a settlement. Unfortunately, the insurance company is not looking to make a large payout. Quite the opposite, in fact—it is the insurance adjuster’s job to minimize payouts. Thus, the negotiation process is something you must take very seriously.

Oftentimes personal injury victims make small mistakes during the negotiation process, which can end up costing them significantly in the long-run. Before you say anything to the insurance adjuster, you should consult with a personal injury attorney. Find an attorney you can trust, and listen closely to their advice.

Avoid these 8 mistakes people make during settlement negotiations:

- Taking the insurance adjuster’s role for granted. The insurance adjuster works for the insurance company, and their top priority is their company’s bottom line. They are good at what they do, and that can be detrimental for your case. Be polite, but do not let your guard down and say something they can use against you.

- Discussing more than the facts. While negotiating the settlement, you want to stick to the facts of the case. Do not embellish or offer up anything subjective. Your opinions or interpretations about what happened could be taken out of context and used against you.

- Exaggerating or lying. Never exaggerate an injury, because the truth will eventually come out. Give only the facts about your injury and the accident. If the adjuster senses you are exaggerating, they will be far less likely to agree to settle your case fairly.

- Giving the adjuster too much personal information. Once again, you must recognize the insurance adjuster is not on your side. They might ask you for personal information, like your Social Security number, which you are not required to give them. And although using your Social Security number to check your credit and other personal information is prohibited, you never know who you might be dealing with. Stay on the safe side and decline to give any personal information unless it is required.

- Discussing pre-existing injuries. An insurance adjuster is not qualified to assess whether a pre-existing injury has anything to do with the injury you suffered during the accident. Only a medical doctor can do this. If the adjuster asks about pre-existing injuries, decline to comment. Later on in the process, the insurance company might have you submit to an independent medical examination, or request your medical records from your doctor. But during the initial settlement negotiations, you should not discuss your pre-existing injuries. Once again, though, never stretch the truth—just decline to comment until you have consulted with your attorney.

- Answering questions you don’t know the answer to. It is completely acceptable to admit you do not know the answer to a question posed by the insurance adjuster. In fact, it is much better to say that you don’t know, rather than give an answer you are unsure about. Anything inaccurate that you say could end up being used against you.

- Signing medical releases early on into treatment. If you are still being actively treated for your injuries, do not sign a medical release for the insurance company. Releasing your records too early into the process will give them an incomplete idea of your injuries. Your condition might change over time, and it is important to make sure your medical records accurately reflect the injuries you suffered and treatment you received.

- Rushing the settlement. While you certainly do not want the process to drag out for too long, rushing to settle is not recommended. The insurance company will start the negotiations with a number that is well below what your case is worth. They want to settle the claim as quickly and cheaply as possible, but that is not in your best interest. Be patient and listen to your attorney’s advice as you navigate the settlement negotiations.

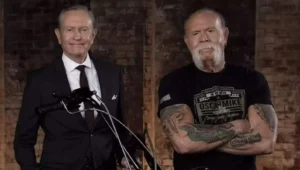

“Negotiating your personal injury settlement can be stressful. Fortunately, our firm is very experienced in the process, and we are here to help our clients every step of the way,” said Attorney Walter Clark, founder of Walter Clark Legal Group.

Our firm has been handling personal injury cases throughout the California Low Desert and High Desert communities for over 30 years. With a 95% success rate, the California personal injury attorneys at Walter Clark Legal Group will fight to hold those responsible for your loss accountable and win compensation to cover medical bills, lost wages, and pain and suffering. If you have been injured and want to discuss your legal options, contact us today for a free consultation with an experienced personal injury lawyer. We have offices in Indio, Rancho Mirage, Victorville, El Centro, and Yucca Valley, and represent clients through the entire California Low Desert and High Desert communities.

DISCLAIMER: The Walter Clark Legal Group blog is intended for general information purposes only and is not intended as legal or medical advice. References to laws are based on general legal practices and vary by location. Information reported comes from secondary news sources. We do handle these types of cases, but whether or not the individuals and/or loved ones involved in these accidents choose to be represented by a law firm is a personal choice we respect. Should you find any of the information incorrect, we welcome you to contact us with corrections.

- What To Do If You Have Been Injured At A Concert In California? Mar 27,2024

- Walter Clark Legal Group Reimburses Thanksgiving Ride Fares Nov 14,2023

- Walter Clark Legal Group Donates Backpacks to Booker T. Washington Elementary School Aug 22,2023

- Walter Clark Legal Group Donates Backpacks to Underserved Students Aug 22,2023

- Walter Clark Legal Group Reimburses Labor Day Ride Fares Aug 21,2023

- 2023 Safe Ride Home Program Jun 21,2023